Assam Circle Branch, Meghdoot Bhawan, Panbazar, Guwahati- 781001 [President- Shri N. R Saikia, AD, Assam Circle, Guwahati 781001; (985 405 5283), Vice-President - Shri D.Khanikar, AD,Assam Circle, Guwahati; (94354 87603) Circle Secretary- Shri Utpal Nath, ASRM (Hq), RMS "GH" Dn, Guwahati (986 408 5014, 700 226 4716), Treasurer- Shri Subhasish Bhattacharjee, ASP CO, Assam Circle,Guwahati 781001 (986 444 5713, 700 21 0722)]

Recent Transfer Posting Order

Click to View -

1. CO GHY No Staff/3-4/92/Ch-VIII Dated 07/10/15

2. CO GHY No Staff/1-305/2007 Dated 08/10/15

3. CO GHY No: Staff/3-25/2012/Ch-II Dated 09/10/15

4. No.B-2/7/ASRM/CH-III dtd. 13.10.15

5. Wait for the HOT News

1. CO GHY No Staff/3-4/92/Ch-VIII Dated 07/10/15

2. CO GHY No Staff/1-305/2007 Dated 08/10/15

3. CO GHY No: Staff/3-25/2012/Ch-II Dated 09/10/15

4. No.B-2/7/ASRM/CH-III dtd. 13.10.15

5. Wait for the HOT News

Suggestion regarding enhancement of limit of withdrawal from Rs 5000/- to Rs 10,000/- at BO without obtaining sanction from Account office

FS Division, Department of Post vide Memo No 113-01/2001-SB dated 07/10/2015 has asked for suggestion or views from all HOC, regarding enhancement of limit of withdrawal from Rs 5000/- to Rs 10,000/- at BO without obtaining sanction from Account office. [ Within 15 days]

Earlier the amount was raised from Rs 2000 to Rs 5000/- vide SB Order No 19/2009 sated 14-12-2009.

Earlier the amount was raised from Rs 2000 to Rs 5000/- vide SB Order No 19/2009 sated 14-12-2009.

DOP 60 days Bonus order for the year 2014-2015

Ministry

of Communication & IT, No 26-01/2015-PAP Dated 07/10/2015 Issued 60 days Bonus

order for the year 2014-2015, based on ceiling at Rs 3500/- pm.

RTI information to Applicant- Format Regarding

CLICK TO VIEW DoPT OM No: 10/1/2013-IR DT. 06/10/15

Source: http://ccis.nic.in/WriteReadData/CircularPortal/D2/D02rti

Govt to soon make PAN must for cash spending beyond a limit

New Delhi: To check generation of domestic black money,

the government will soon make it mandatory to furnish PAN card details for cash

transactions beyond a certain threshold, finance minister Arun Jaitley said on

Sunday.

“The

government is at an advanced stage in considering the requirement of furnishing

PAN card details if cash transactions beyond a certain limit are undertaken,”

Jaitley said in a Facebook post. He said the monitoring regime of the income

tax department has been strengthened and its capacity to access information and

apply technology driven analytical tools to expose evasion, has been enhanced.

“Its ability to detect large cash

withdrawals, or large cash transactions which enter the system, is being

strengthened. GST regime once introduced will also be a landmark step in this

direction. “Thus for commodities like gold where the initial purchase by the

exporter is after the payment of custom duty, the subsequent transactions which

are mostly in cash, can easily be found out,” Jaitley said.

NH upgrade: 22,000 km to be made four-lane And 50,000 km addition to NH Network

The roads ministry is ready

with a proposal for upgrading 22,000 km of national highways at an estimated

cost of Rs 4 lakh crore over the next five years and will soon seek cabinet

approval to lower the current traffic threshold for upgrading two-lane national

highways to four-lane highways. The clearance is expected to come later this

month.

The 22,000 km to be taken up for upgradation account for over a fifth of the current NH network of 100,000 km. According to MoRTH data, 30 per cent of the existing national highways have less than two lanes, 48 per cent have two lanes and 22 per cent have four lane and more.

The 22,000 km planned for upgrade are in addition to the 50,000 km that the roads ministry will add to the national highways network. This includes projects under the Bharat Mala programme, roads being considered for connecting district headquarters, backward areas and religious/ tourist centres, and state highways identified for addition to the NH network by the end of the fiscal year.

The 22,000 km to be taken up for upgradation account for over a fifth of the current NH network of 100,000 km. According to MoRTH data, 30 per cent of the existing national highways have less than two lanes, 48 per cent have two lanes and 22 per cent have four lane and more.

The 22,000 km planned for upgrade are in addition to the 50,000 km that the roads ministry will add to the national highways network. This includes projects under the Bharat Mala programme, roads being considered for connecting district headquarters, backward areas and religious/ tourist centres, and state highways identified for addition to the NH network by the end of the fiscal year.

Declaration of Assets and Liabilities by public servants under section 44 of the Lokpal and Lokayuktas Act, 2013

Declaration of Assets and Liabilities by public servants under section 44 of the Lokpal and Lokayuktas Act, 2013 to be submitted to the competent authority on

or before the 15th day of October, 2015.

For forms in Excel Format- CLICK HERE

For forms in Excel Format- CLICK HERE

Representation from Govt Servant on service matters-reiteration of instructions- regarding

Ministry of Personal, Public Grievances and Pension, F No 11013/08/2013-Estt (A-III) dated 31/08/2015

CLICK HERE to view

CLICK HERE to view

Clarification regarding Procedure for booking of air-tickets on LTC.

Click Here to View

Ministry of Personnel, Public Grievances and Pensions, Department of Personnel and Training Memo No 31011/5/2014-Estt (A.IV) Dated: September 23, 2015

Possible Cut in Small Savings Interest Rate

The government has decided to review

the small savings rates, which remain sticky at 8.4-8.5%, limiting banks'

ability to lower deposit rates and slowing down the transmission of Reserve

Bank of India's softer monetary policy decisions. "It has been decided that with

regard to the transmission of the rates, the government will undertake a review

of the small savings rate also," economic affairs secretary Shaktikanta

Das said."Small savings is a decision the government has taken in response

to the policy rate announced by the RBI," he said.

Banks

reduced deposit rates aggressively over the last three quarters with some

lowering term deposit rates by 50-75 bps but matching cuts in lending rates

come with a lag. But they have time and again whined that high interest rates

on small savings such as public provident fund or post office monthly income

schemes are stopping them from lowering deposit rates beyond a point and this

inability prevents them from making loans cheaper.

Senior citizens get 9.3% from post

offices, 100-130 bps higher than what they get from most state-run banks.

"A major part of small savings comes from the risk averse segments and for

them it is the means of subsistence. The country's largest bank, State Bank of

India, cut deposit rates by 25 bps across maturities effective from October 5.

Its medium-term deposit rate is 7.75%

at present while small savers enjoy 8.4% rate for deposits below five years

from post offices and for the popular monthly income scheme. Public provident

fund offers 8.7% rate a year.

Source : The Economic Times

CSI - POINT OF SALE FOR POST OFFICE

Overview

Login for each of the module is based on roles

User ID is created centrally and shared with each and every

individual separately

Roles and Password are setup at the Identity Access Management (IAM) application

Individual applications use the centrally set up password

7th CPC report submission date - COC Karnataka

7th CPC report submission date - COC Karnataka

Comrades,

There are lot of enquiries about the 7th CPC report submission. Let us examine the following facts.

1) The 7th CPC had issued following statement in July 2015 in its website http://7cpc.india.gov.in/ . Even today the same status is existing.

“Further to the memoranda received from a variety of Organisations, Federations, Groups representing civil employees in the Government of India as also from the Defence Services, the Commission has had fruitful and wide ranging discussions on relevant issues with all stakeholders. Such interactions have now been concluded. Valuable inputs have been received and the work of compilation and finalization of the report is underway, so that the Commission completes its task in the time frame given to it. Accordingly, any future requests for meeting with the Commission will not be entertained.”

This shows clearly that the 7th CPC wanted to present its report on 28th August 2015 itself with no extension of time.

2) On August 7, 2015 National Council (Staff Side) Secretary Comrade Shiva Gopal Mishraji met the Chairman, Seventh Central Pay Commission, Shri Ashok Kumar Mathur and Secretary, Mrs. Meena Agarwal. It was assumed that the report of the VII CPC, as was promised for 28th August this year, may be delayed by one month.

This shows that the 7th CPC was delayed only one month.

3) Many news papers including Danik Bhaskar, Times of India, NDTV CNN IBN, Hindu etc had reported that the 7th CPC will be submitting its report on 30th September 2015 itself.

4) The 7th CPC chairman had informed in a PTI interview Justice Ashok Kumar Mathurji had stated that “The Commission will submit its report by the end of September,”

5) The Hon’able Finance Minister had also informed the 7th CPC report will be submitted shortly.

6) The 7th Pay Commission has asked for a two month extension from the government. That the Commission is hoping that the government would take a call on One Rank One Pension, so they could modulate their own formulation in terms of pay revision. Now the one rank one pension issue has been resolved, but the formal orders are not issued, it will be issued only next month. After the issue of the ORBP orders then 7th Pay Commission will submit its report.

7) Now four month extension of term of 7th Central Pay Commission is made the Union Cabinet chaired by the Hon’able Prime Minister, gave its approval for the extension of the term of the 7th Central Pay Commission by four months up to 31.12.2015. The Government had issued notification on 8th September “The Commission will make its recommendations by 31st December, 2015. It may consider, if necessary, sending reports on any of the matters as and when the recommendations are finalized.”

8) Now the delay in submission of report and its implementation will be there and actual benefit of 7th CPC will occur only from April 2016. As Government will constitute its own committee to study the implementation of the 7th CPC report and issuing orders. It will benefit the Government as allowances effective date may be from April 2016 instead of January 2016.

9) When will the 7th CPC submit its report? There are three possibilities now on submission date.

a) If the 7th CPC feels that the assigned work has been completed it can submit its report any time, it’s only up to the 7th CPC and the Central Government. If the 7th CPC report is completed and ready for release as per paper reports then in these case the 7th CPC can directly submit its report to the Finance Ministry on 30th September without publishing the report in public due to Bihar elections. If election commission gives clearance then the 7th CPC report will be made public.

b) There is one more possibility is that the 7th CPC report will be submitted after Bihar elections ie after November 6th.

c) Last option is that report will be submitted only in December 2015 only.

We sincerely hope the 7th CPC report will be submitted at the earliest and the Central Government will implement the report at the earliest, so that the aspiration of the Central Government employees are taken care by the Central Government.

Comradely yours

(P.S.Prasad)

General Secretary

Source: http://karnatakacoc.blogspot.in/

Grant of Dearness Relief to Central Government pensioners/family pensioners – Revised rate effective from 1.7.2015.

Grant of Dearness Relief to Central Government pensioners/family pensioners – Revised rate effective from 1.7.2015.

Ministry of Personnel, Public Grievances & Pensions, Department of Pension & Pensioners’ Welfare, No F. No. 42/10/2014-P&PW(G), Date : 28th Sept, 2015

.............the President is pleased to decide that the Dearness Relief (DR) payable to Central Government pensioners/family pensioners shall be enhanced from the existing rate of 113% to 119% w.e.f. 1st July, 2015.............

Circulation of Fake order for extension of due date for filing of Audit report and return of Income for Assessment Year 2015-16

Circulation of Fake order for extension of due date for filing of Audit report and return of Income for Assessment Year 2015-16

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

PRESS RELEASE

New Delhi, 28th September, 2015

Sub: Circulation of Fake order for extension of due date for filing of Audit report and return of Income for Assessment Year 2015-16-regarding

It has been brought to the notice of the Government that a fake order dated 26th September 2015 supposedly under section 119 of the Income-tax Act 1961 under the signature of one Upmanyu Reddy, Under Secretary to the Government of India is in circulation. The fake order extends the due date for filing of audit report under section 119 of the Income-tax Act to 15 October 2015.

It is clarified the order is fraudulent. The Government has not extended the due date for filing of returns and audit report due by 30th September 2015. Tax payer and practitioners are advised not to give any credence to the fraudulent order purportedly signed by one Upmanyu Reddy.

(Shefali Shah)

Pr. Commissioner of Income Tax (OSD)

Official Spokesperson, CBDT

Authority : www.incometaxindia.gov.in

July 2015 DA Order

Payment of Dearness Allowance to Central Government employees – Revised Rates effective from 1.7.2015, vide Ministry of Finance, Department of Expenditure Memo No. 1/2/2015-E-II (B) Dated: 23rd September, 2015.

................ President is pleased to decide that the Dearness Allowance payable to Central Government employees shall be enhanced from the existing rate of 113% to 119% with effect from 1st July, 2015....

Click for Original Order

Click for Original Order

2004 से बंद फैमिली पेंशन फिर शुरू कर सकती है सरकार

Source: http://www.bhaskar.com/news/MP-BPL-HMU-family-pension-can-start-again-from-2004-to-the-government-5115635-NOR.html

भोपाल. केंद्र और राज्यों के 33 लाख कर्मचारियों के लिए यह अच्छी खबर है। सरकार उन्हें अगले साल से फैमिली पेंशन देने पर विचार कर रही है। सातवें वेतन आयोग की सिफारिशों में इसका प्रावधान किया गया है। प्रदेश सरकार को दिसंबर माह तक केंद्र सरकार को अपनी रिपोर्ट सौंपनी है, जिसे मंजूरी मिलने के बाद कर्मचारियों को इसका लाभ 1 जनवरी 2016 से मिल सकता है।

अभी अप्रैल, 2004 के बाद सरकारी नौकरियों में भर्ती हुए अफसर से लेकर कर्मचारियों को अंशदायी पेंशन मिलती है, जबकि इससे पहले के कर्मचारियों को फैमिली पेंशन मिल रही है।

इसमें न्यू पेंशन स्कीम (एनपीएस) के तहत भर्ती हुए कर्मचारियों की परेशानी यह है कि उन्हें रिटायरमेंट के बाद पेंशन मिलेगी या नहीं, यह तय ही नहीं है।

इसके तहत उनके वेतन से 10 प्रतिशत और इतनी ही राशि सरकार के अंश की होती है। रिटायरमेंट तक यह राशि काटी जाएगी जिसमें से 70 प्रतिशत राशि कर्मचारी को नकद दी जाएगी और बाकी 30 प्रतिशत पेंशन फंड के लिए जमा किए जाने का प्रावधान है जिसमें से उन्हें जीवित रहने तक आंशिक पेंशन दिया जाना है।

अभी यह है प्रावधान : अभी अप्रैल, 2004 से पहले नौकरी में भर्ती हुए कर्मचारियों को फैमिली पेंशन मिल रही है। इसमें पेंशन के नाम पर उनके वेतन से कोई राशि नहीं काटी जाती है। रिटायरमेंट के वक्त अंतिम माह को जो वेतन देय होता है, उसकी 50 फीसदी राशि पेंशन के रूप में तय हो जाती है। यह राशि उन्हें जीवित रहने तक मिलती है और उसके बाद आश्रित को ट्रांसफर हो जाती है।

13 लाख से ज्यादा भर्तियां

केंद्र में अप्रैल 2004 से अब तक 13 लाख 46 हजार 862 भर्तियां हुईं, वहीं राज्यों में यह संख्या 19 लाख 58 हजार 378 है। इनमें मप्र में हुई भर्तियां 62 हजार हैं। इन कर्मचारियों के लिए अंशदायी पेंशन का प्रावधान है। इनके वेतन से हर महीने काटी जा रही 10 प्रतिशत राशि के अलावा इतनी ही राशि सरकार मिला रही है। इस फंड में एनएसडीएल के पास अब तक तक 42 हजार करोड़ रुपए जमा हो चुके हैं।

केंद्र में अप्रैल 2004 से अब तक 13 लाख 46 हजार 862 भर्तियां हुईं, वहीं राज्यों में यह संख्या 19 लाख 58 हजार 378 है। इनमें मप्र में हुई भर्तियां 62 हजार हैं। इन कर्मचारियों के लिए अंशदायी पेंशन का प्रावधान है। इनके वेतन से हर महीने काटी जा रही 10 प्रतिशत राशि के अलावा इतनी ही राशि सरकार मिला रही है। इस फंड में एनएसडीएल के पास अब तक तक 42 हजार करोड़ रुपए जमा हो चुके हैं।

सातवें वेतन आयोग की रिपोर्ट में यह माना जा रहा है कि न्यू पेंशन स्कीम को रिवाइज किया जाएगा, जिसे फैमिली पेंशन में परिवर्तित किए जाने की पूरी उम्मीद है। ऐसी हमारी लगातार मांग भी रही है। यदि केंद्र इस सिफारिश को मानता है तो इससे बड़ी संख्या में कर्मचारियों का फायदा होगा। -केकेएन कुट्टी, अध्यक्ष, केंद्रीय कर्मचारी परिसंघ, नईदिल्ली

- सरकारी सेवाओं में 1 अप्रैल 2004 से फैमिली पेंशन खत्म कर दी गई थी। सरकार का यह कदम ठीक नहीं था। पेंशन ही एक ऐसा आकर्षण है, जो लोगों को सरकारी सेवाओं में आने के लिए आकर्षित करता है। सातवें वेतन आयोग में इसकी अनुशंसा करता है और केंद्र इसे मानता है तो कर्मचारियों के हित में फायदेमंद होगा। केएस शर्मा, पूर्व मुख्य सचिव, मध्यप्रदेश

इसलिए पड़ी जरूरत

पिछले 11 साल से सरकार में भर्ती होने वाले कर्मचारियों को रिटायरमेंट पर सोशल सिक्युरिटी के रूप में मिलने वाली पेंशन का कोई प्रावधान नहीं है। इससे सरकारी सेवाओं में आने वाले युवाओं का रुझान भी घटा। यह इससे साफ होता है कि 1 अप्रैल 1994 से 1 अप्रैल 2004 के बीच जहां 50 लाख से ज्यादा लोग नौकरी में आए। वहीं, पेंशन खत्म होने के बाद सिर्फ 33 लाख लोग ही नौकरी में आए।

यदि केंद्र फैमिली पेंशन की अनुशंसा को स्वीकार करता है तो हम इसे राज्य में लागू करने पर विचार करेंगे। -जयंत मलैया, वित्त मंत्री

FULL PENSION FOR THOSE WITH QUALIFYING SERVICE LESS THAN 30 YEARS BUT MORE THAN 20 YEARS.

In view of the fact that review Petition filed by UOI RP (C) NO. 2565/2015 in SLP (C) No. 6567/2015 UOI Vs M.O. Inasu dismissed by HSC on 28.8.2015, and Following file notings of DOPW (obtained under RTI)let us hope DOP&PW will now issue necessary instructions extending benefit of full min. pension to all pre 2006 pensioners irrespective of Q.S. rendered.

The extract from the File Noting obtained from DOP&PW under RTI ACT, on pro rata pension matter.

Extract from File Noting of DOP&PW OM 30.7.2015 obtained under RTIA:

12. It may be mentioned that in its order dated 22.1.2013 and 16.8.2013 in OA No. 715/2012 and OA No. 1015/2012 respectively, Hon’ CAT Ernakulam Bench directed that the revised pension fixed in terms of para 4.2 of OM dt. 1.9.2008 would not be reduced pro rata in cases where the qualifying service of a pre 2006 pensioner was less than 33 yrs. This order of Hon CAT was challenged by D/o Revenue in the H.C. of Kerala in OP(CAT) No. 4/2012 and No. 8/2012. Hon’ H.C. of Kerala dismissed the Op(CAT) No. 4/2012 and No. 8/2012 vide order dt. 7.1.2014. The SLP filed by the Dept. of Revenue against the order dt. 7.1.2014 has also been dismissed by Hon’ S/C. in its order dated 20.2.2015. Learned ASG, Sjri P.S.Narsimha has advised to file a Review Petition. The concerned file is presently with MOL(CA Section) and Ms. Rekha Pandey, Adv. is drafting the RP.

13. As already mentioned above, in the order dt. 29.4.2013 of Hon HC of Delhi in WP No. 1535/2012, it was observed that the only issue which survived was, with ref. to para 9 of OM dt. 28.1.2013 which makes it applicable from 24.9.2012 instead of 1.1.2006. In view of this observation of the Hon H.C. of Delhi, we may issue orders for giving effect to the OM dated 28.1.2013 w.e.f. 1.1.2006 instead of 24.9.2012. The question whether or not the revised pension in terms of OM 28.1.2013 would be reduced proportionally would be examined once the order of the Hon S.C. in the RP to be filed against dismissal of SLP 21044/2014 is available ( para 12 above)( emphasis added)

Sd. S.K. Makkar US

17.4.2015

Noting of Secy(P)

Noting of Secy(P)

6. Thus the court ruling has become law of the land

7. Given the fact the review/curative petition in the same matter has once been dismissed by Hon. Apex Court, as also the fact that Civil Appeal of Ministry of Defence with which the SLPs in question got tagged, has also failed, there is no chance that a review petition may yield a different result. On the other hand this will not only engage the govt. machinery in uncessary litigation but will also result in attendant avoidable expenditure. ( emphasis added)

Sd.

Alok Rawat Secy/ Pension 22.4.2015

Alok Rawat Secy/ Pension 22.4.2015

Hon MOS(PP)

Sd. 7.5.2015

Sd. 7.5.2015

Source-http://scm-bps.blogspot.in

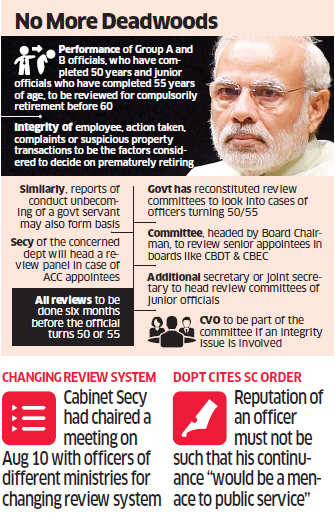

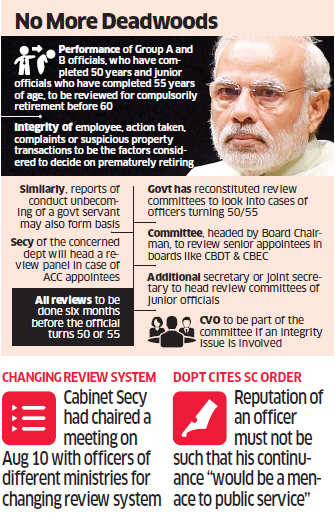

Government to compulsorily retire officers with bad reputation or inefficient

Issuing four-page long guidelines to all ministries last Friday, the PM-led Department of Personnel and Training (DoPT) has said that services of those government officials "which are no longer useful to the general administration" or whose "integrity and reputation" is doubtful, must be compulsorily retired from service.

As per an existing rule FR 56 (J) which has been rarely enforced, the performance of Group A and B officials who have completed 50 years and junior officials who have ..

As per an existing rule FR 56 (J) which has been rarely enforced, the performance of Group A and B officials who have completed 50 years and junior officials who have ..

Verification of qualifying service after 18 years service and 5 years before retirement

G.I., Dept. of Per. & Trg., O.M.No.1/19/2013-P&PW(E), dated 16-9-2015

Sub: Verification of qualifying service after 18 years service and 5 years before retirement.

It has been observed by this Department that processing of pension cases of the employees retiring from the government service quite often get delayed on account of the issues relating to verification of service from time to time by the concerned authorities during the service of the concerned employee. Although detailed instructions regarding verification of service have been issued by Department of Personnel & Training and by this Department, these instructions are not meticulously adhered to resulting in delay in sanctioning of retirement benefit of the employees.

2. Rule 32 of the CCS (Pension) rules, which existed prior to December, 2012 provided for issuing of a certificate in Form 24 by the Head of Office in consultation with by the Account Officer regarding completion of qualifying service of 25 years. These rules have been amended subsequently and as per the existing provisions, a certificate regarding qualifying service is required to be issued by the HOO after completion of 18 years of service and again 5 years before the date of retirement of an employee. Rule further provide that verification done under that rule shall be treated as final and shall not be reopened except when necessitated by a subsequent – change in the rules and orders governing the conditions under which the service qualifies for pension.

3. It has been noticed that the certificates regarding qualifying service are not invariably issued to the government servant as required under the rules. All Ministries/Departments etc. are therefore requested to bring these provisions to the notice of Heads of Offices and PAOs for strict compliance. Non-compliance of this statutory requirements may be viewed seriously.

4. In order to review status regarding compliance of these rules, all Ministries/Departments are requested that the information may be collected from all establishments / office under them and the same may be compiled and sent to this Department by 15th October, 2015 in the enclosed proforma.

From IPs/ASPs (CHQ): PS Gr. B for the vacancy year 2015-16

Directorate has called for the vacancy position in PS Gr. B cadre as on 1/9/2015, 1/10/2015 and 1/11/2015 from all circle by return post. The details of PS Gr. B officers working in other circles has also been called for to decide their request applications for repatriation to parent circle. It is believed that the DPC would be convened in the 1st week of October 2015, if all circles will co-operate for submission of requisite information to Directorate within 2 days.

Subscribe to:

Posts (Atom)